Q1-2022 Dynamk Life Science Industrials INSIGHTS: Trends, Transactions & Headlines

In This Report

M&A Events

Top Headlines

Dynamk Insights

VC Investments

Recommended Reads

M&A and IPO activity dropped back to more typical levels. Q3-4 '21 were considered outliers with significant deals happening; ThermoFisher completed its $17B acquisition of PPD in December '21, Icon completed its $12B acquisition of PRA Health Sciences in July '21, and PerkinElmer's acquisition of BioLegend, $5.25B.

Top Headlines

ThermoFisher Boosts Reagent Business with $1.85B PeproTech Buy

The deal adds critical raw materials to Thermo's offering such as cytokines, antibodies, ELISA, and cell culture media kits for the development and manufacturing of biologics and cell and gene therapies. This was ThermoFisher's first deal of 2022 and represents a continued aggressive M&A strategy.

Press Release

Synthego Accelerates Genome Engineering (CRISPR) Technology with $200M Series E

Synthego will use the funds to "automate biological research", and the creation of a cell and gene therapy discovery and development ecosystem. The company leverages machine learning, automation, and gene editing to build platforms for science at scale.

Press Release

DNAnexus Secures $200 Million Funding to Advance its Biomedical Data-Driven Technology Platform

Led by Blackstone Growth, the Series I round will help DNAnexus continue its investment in its cloud-based biomedical data analysis software, a critical tool for geneticists.

Press Release

Dynamk Insights

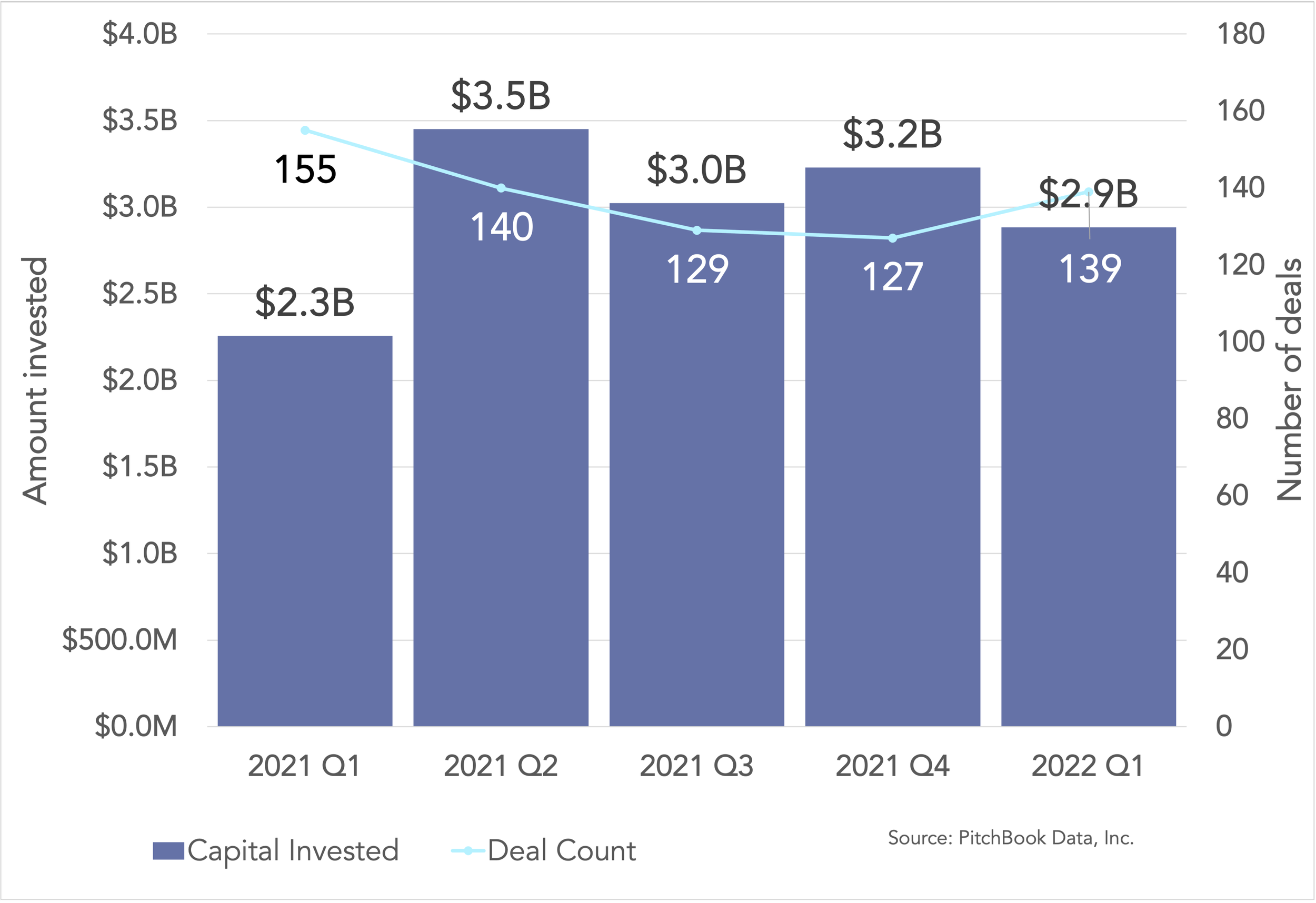

The momentum we saw through 2021 in VC appears to have continued through into Q1 of 2022. The broader VC ecosystem appears to have slowed down by roughly 20% in total dollars invested, but is still significantly higher than quarterly investments in 2019 and 2020. Life Science Industrials (LSIs) saw a slower decline of about 10% compared to Q4, but the number of deals is up. Big firms are continuing to invest in this space with Lilly pouring $700M for a gene therapy-focused site in Boston, and Leaps by Bayer launching a $1.3B fund focused on cell and gene therapy space.

There has been a general concern about the poor biotech performance in public markets and a potential overall slowdown in later-stage financing. There is a belief that valuations will come down some and that there will be a “flight to quality” – companies with sound financials and validated business models will get a bigger share of the funding.

The other big trend we have felt in LSI sector is the growing interest of PE firms to play in this space acting as aggregators. There are a number of areas i.e., organ-on-a-chip, cell line disease models, that have many smaller poorly differentiated players that could be bundled under a single platform.

Venture & Growth Investing in Life Science Industrials

Life Science Industrials Funding

There was a 10% drop in LSI investing from Q4 however the number of deals is up reflected in smaller check sizes to Seed and Early Stage rounds. Despite the slight drop since Q4 ’21, Q1 closed 26% higher than the previous year and nearly 3.5x Q1 ’20, similar to last quarter.

Investments by Stage

The ratio of seed, early, and later-stage deals remained similar to Q4 2021 indicating a continued healthy mix of new innovative startups and successful LSIs seeking capital to expand.

Dynamk Recommended Reads

Business

Erbi Biosystems Raises $4M to continue development of small-Scale perfusion bioreactors for Cell Therapies

Univercells adds DNA synthesis to offering through SynHelix buy

Lonza teams with analytics leader Agilent to make cell therapy Cocoon platform ‘smarter’

CDMO Performance Cell Manufacturing (PCM) acquired by PE, renamed Cellipont Bioservices

Synthetic biology 64x spun is set to tackle the gene therapy manufacturing bottleneck with $55M in a Series A financing

Univercells and RoosterBio target regen med using extracellular vesicles (EVs) and continuous bioprocessing technologies

Ori Biotech's Oversubscribed $100M Series B Launches Cell and Gene Therapy Manufacturing Platform

Intellia expands gene editing toolkit with $45m Rewrite buy, expanding CRISPR functionality

Manufacturing

Excellos enters cell therapy CDMO space with $15M in Growth funding

Pfizer realizes $37B from COVID vax with another $32B expected in 2022

US Government awards $250M contract to Resilience for monoclonal antibody (botulinum)

Lilly bets on RNA research with $700M Boston plant

Research and Development

Tech development firm TTP and CellFiber partner to ‘revolutionize’ CGTs with new bioreactor format

FDA approves a CAR-T therapy developed by Johnson & Johnson and its partner Legend Biotech

*Note: reported transaction amounts and timing are subject to change dependent on final closings.